Now this may seem to be an odd article. In fact, it’s not really an article, in the sense of a worked out theme. Instead, it looks at what we should all know about two things that cost us all a lot of money and discombobulation: council tax and electric smart meters, with information I’ve been able to dig up, a little advice and appeal for more information and opinion so that we can build up an accurate idea of what our concerns ought to be and what our options are.

Firstly, the absurd Council Tax. When so many other websites and influencers are suggesting refusing to pay it, I remain unconvinced that you will not end up with a spell at His Majesty’s Pleasure if you decline to pay your Council Tax. Starmer would be all too keen to influence the judiciary to impose unjust punishments. Where have we heard that before?

From my experience in persuading a neighbour to challenge and that being declined, together with discovering some government guidance, I can only conclude the messaging is now towards councils declining these appeals. Councils claiming financial losses will also influence them.

I have experience of challenging Council Tax banding. I have done it twice on the same house, the first time unsuccessfully, the second time I was successful and received a refund of over £8,000 in over payment on too high a band. Being back dated to when I moved into that house.

For me the whole system of the way Council Tax is calculated is farcical in its concept, I thought Poll tax was a far fairer system, but then as a single man, living in a three-bedroom property, I would say that. We all know the Poll Tax riots brought that method to an early end. Obviously, individuals living alone, or as a couple in larger houses are unlikely to go out and riot.

If you can think of a fairer system, please feel free to share in the comments.

Back then my water rates were based on those Council Tax bands (few houses had meters) and I worked away half the year, and I was paying the same for water as four adults next door!

Tax bands are based on 1st April 1991 property values. April Fool’s Day does seem applicable from my experience, regarding consistency in the banding, as well as the whole concept.

Council Tax bands and rates: London

| Valuation band | Value of property | Council Tax 2024 - 2025 | |

|---|---|---|---|

| A | Up to £40,000 | £1,357.37 | |

| B | £40,001 - 52,000 | £1,583.59 | |

| C | £52,001 - 68,000 | £1,809.82 | |

| D | £68,001 - 88,000 | £2,036.05 | |

| E | £88,001 - 120,000 | £2,488.51 | |

| F | £120,001 - 160,000 | £2,940.96 | |

| G | £160,001 - 320,000 | £3,393.42 | |

| H | £320,001 and over | £4,072.10 |

Note. The band values are applicable throughout England and Wales

Council Tax rates for Norwich for 2024. Showing differences from the lower band

| A | £1,523.49 | |

| B | £1,777.40 | + £254 more than band A |

| C | £2,031.32 | + £254 more than band B |

| D | £2,285.23 | + £254 more than band C |

| E | £2,793.06 | + £508 more than band D |

| F | £3,300.89 | + £508 more than band E |

| G | £3,808.72 | + £508 more than band F |

| H | £4,570.46 | + £762 more than band G |

Surprisingly Norwich cost/band are higher than London’s. But it is difficult to believe there were any properties valued in London in band A!

Consider your property was valued at £320,500, and not £319,500. You pay £762 per year more!

When I bought my current house near Norwich, I was rather shocked by the increase in Council tax I was to pay compared to my smaller house back near Grimsby. I enquired with the council about how to appeal against the band, I was told new occupants can appeal in the first six months of moving into a property. I completed that process within that timescale, which was a paper-based appeals system, and my challenge was rejected.

Since the 1990s, the internet has allowed comparison of house sizes to be easier. Google maps show footprints of properties. Previous Estate Agent brochures as captured in Zoopla, usually show square meters of those properties. Together with locating data sources such as establishing bands in Post Codes.

I created a spreadsheet and entered the 30 houses in my Post Code with each properties banding, and the areas of those properties. It became obvious there were larger properties in my Post Code, that had lower bandings. It was also obvious (to me) that certain smaller properties had been undervalued. There are inconsistencies, and this is how you challenge.

The appeals system is now an online system, rather than paper based.

The first place to start, if you suspect you are in too high a band is this Government site:

https://www.gov.uk/government/organisations/valuation-office-agency

Select ‘Check your Council Tax Band or direct via……

https://www.tax.service.gov.uk/check-council-tax-band/search

Enter your Post Code and be prepared to be shocked.

Basically, you are trying to confirm to your local authority that there are larger properties in the same Post Code on lower bandings than your property.

Here follows the government guidelines (I was not aware of this when I successfully appealed) and this guidance is what makes me certain most challenges will be declined:

Evidence that supports your challenge

You’ll be asked for evidence that your Council Tax band is wrong when you challenge a Council Tax band in England or Wales. You’ll need to give your evidence when you apply.

Check how to challenge your Council Tax band in Scotland.

If there’s been a change that affects the property

If you’re proposing a new band, you must provide one of the following pieces of evidence:

- a description of any changes to your property - if it has been split into multiple properties or merged into one

- details of your property’s change of use - if part of your property is now used for business

- a description of how your local area has changed physically - for example, if a new supermarket has been built

- details of any physical works which have taken place to your property

- If you think your band is wrong

You’ll need to provide addresses for up to 5 similar properties in a lower band than yours.

The properties should be the same as your property in terms of:

- type - for example, if you live in a semi-detached house the properties should be semi-detached houses

- size - for example, number of bedrooms and total area

- age

- style and design

The properties should also be either:

- in the same street or estate - if you live in a town or city

- in the same village - if you live in the countryside

Evidence from house prices

You can also use the price that your property or similar properties sold for as evidence, if the sales were between:

- 1 April 1989 and 31 March 1993 - if your property is in England

- 1 April 2001 and 31 March 2005 - if your property is in Wales

You can look up property sale prices online from 1995 onwards. (GB: This takes you to HM Land Registry search facility, but I was unable to find any local properties)

Compare the sale prices to the prices the properties are valued at for Council Tax.

If the sale prices are outside the Council Tax band, you can use this as evidence. You will need to give:

- the addresses of the properties

- the sale prices

- the dates the properties were sold - the closer this is to the valuation date, the more likely the Valuation Office Agency (VOA) will be able to use this evidence.

The VOA will not consider average house price information from websites such as Nationwide House Price Index, Nethouseprices, Rightmove or Zoopla as strong evidence.

NB. VOA = Valuation office Agency

https://www.gov.uk/government/organisations/valuation-office-agency

Reading the above, which I was not familiar with when I successfully appealed. It reads to me to be a means to make challenges less successful. I do not understand the reference to a supermarket being built nearby, I can appreciate that would impact on the property’s future sale potential and value. I most definitely did not find evidence of 5 properties. In my case only 1.

But when I appealed the first time (back in the day, when one actually had verbal communications) I remember distinctly part of that conversation, when I called the relevant council Dept by phone. I was banging on about mine only being three bedrooms. The ‘Appeals Officer’s’ response was: “it is not about number of bedrooms; it is about total area of building”

I also have an example of another unsuccessful appeal: one of my neighbouring properties, a bungalow that I was familiar with, and for me, was far more worthy than mine to be a successful challenge. I measured its footprint, and it was a lot smaller than another neighbouring bungalow that was in a Band lower, as I had the actual Estate Agent’s property details of that property’s size from when that was last sold. Google earth also clearly showed it to be larger.

And here lies the enlightening reality: the utter inconsistency in banding determination.

My intention from my own success was to appeal on behalf of the old lady that lived there. But sadly, she was in a care home and never came back out. I did pass my views on to the new owners, suggesting they appeal. I provided them my records about comparative sizes within our Post Code. They challenged the banding and were rejected! and both of them work (from home) for the council!

My conclusion being that the VOA has moved the goalposts. I believe as councils claim to be struggling financially. I expect that less challenges are successful nowadays. However, I believe it is still worth trying, especially if you determine there are numerous houses in your area that are similar or larger and in a lower band.

Here is another anomaly of the system. Whilst checking on Google Earth in my Post Code for building size comparisons. I came across one pair of semis, both in Band B. Which both had an incredible low value of only up to £52,000 in 1991. One semi has an extension at the rear, and is now around twice its original size, and yet both remain as Band Bs!

Clown World continues.

And onto the even more absurd world of smart meters. I recently promised to provide some more guidance for people being pressured by their energy supplier to install them. For me: things have gone quiet on the emails/texts/phone calls front from my provider (Scottish Power). I just assumed they were regrouping to try another tack. The offer of £100 off my bill had obviously not swayed me.

They did state that my meter was due an inspection and I assumed at that point that they would be condemning my existing meter. But we never received an inspection, or if we did, it was while we were out. But no further contact was made by the provider. Imagine the distress of them changing it because it was out of certification, just after turning down £100.

Evidently other suppliers are using the same justifications for changing to their customers. EDF is certainly doing that.

This is the link to my first article about this and here are further details and useful links: er details, other than recently discovering a few links. Citizen’s Advice; Money Saving Expert, with more links within the article and a lawyer’s view.

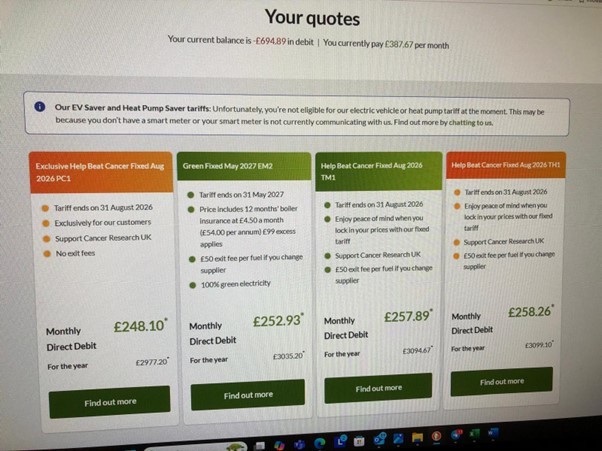

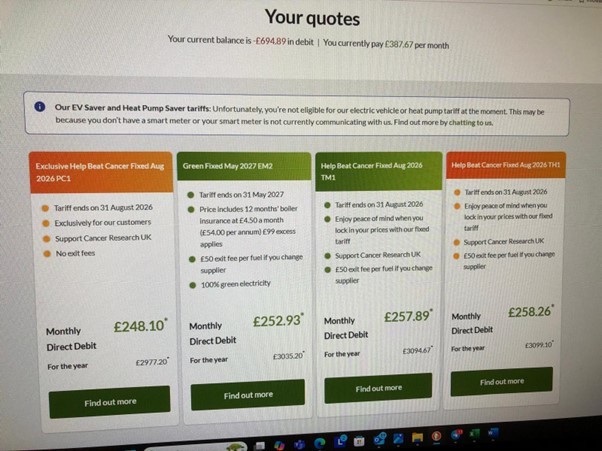

I did a random search within my online account and found yet more causes for annoyance. I hit the ‘change tariff’ button, to see what it would come up with: Let’ s call them all about £250 per month. What is this ‘Support Cancer Research UK’ bullshit?

If I wanted to support them, I would donate independently. And all those years of research have not exactly been fruitful regards curing cancer, have they?

My monthly payments are currently £388 per month.

Not because I live in a mansion, but because we spent months away in winter and my direct debit after that had been reduced to £100 a month, because I built up such a credit.

After we returned and tried to heat the house in spring. We quickly built a large debt, which my supplier is trying to claw back. Perhaps I should consider a smart meter!

More from the Scottish Power account:

How do I get half-price electricity? To get half-price electricity, you just need to:

1. Be a ScottishPower electricity customer. If you’re not yet a customer, we’d love for you to join us here.

2. Have a communicating smart meter. Don’t have a smart meter yet? Book your free installation here.

3. Join Power Saver. Register for Power Saver below and you’ll automatically be included in Half-Price Weekends. We’ll be in touch by email within 7 days to let you know when everything’s ready.

If you are eligible for Power Saver, you can sign up to a half-hourly meter reading frequency as part of the registration process.

If you’re having problems signing up, read our troubleshooting guide.

Our EV Saver and Heat Pump Saver tariffs: Unfortunately, you’re not eligible for our electric vehicle or heat pump tariff at the moment. This may be because you don’t have a smart meter or your smart meter is not currently communicating with us. Find out more by chatting to us.

At least advertisers have moved on from black husband/blonde, white wife:

I was struggling to find any meat for this article, my Editor kindly helped by providing this:

Smart Meters & UK Energy Industry – Reference Facts (2024-2025)

1. Smart Meters Rollout & Technical Issues

• As of 2024, over 60% of UK households have smart meters installed.

• Government target is 75% coverage by end of 2025.

• Approximately 4 million smart meters are faulty, offline, or operating in “dumb mode,” meaning they no longer communicate with suppliers. This represents around 20% failure rate.

• ScottishPower has the highest proportion of faulty meters, with approximately 14.5% of their smart meters not functioning properly.

• Ofgem has introduced rules requiring suppliers to fix broken smart meters within 90 days, or pay £40 compensation to affected customers.

• Reports indicate smart meters frequently revert to dumb mode due to technical faults or connectivity issues.

2. Legal Rights of Consumers

• Smart meter installation is voluntary, unless the existing meter is deemed inaccurate, unsafe, or has reached its certified end-of-life date.

• When a meter is replaced after end-of-life, many suppliers only offer smart meters as replacements due to dwindling stock of traditional meters.

• Consumers can request smart meters to be operated in 'dumb mode', preventing remote readings and real-time data collection.

• Tariffs such as Economy 7 or newer smart-only tariffs may require functioning smart meters to access off-peak rates.

• Customers cannot legally be forced into smart meter installation unless safety regulations require replacement.

3. Supplier Pressure & Coercion Tactics

• Energy suppliers have been criticised for using high-pressure tactics, including:

o Claiming smart meters are mandatory.

o Using safety inspections as a pretext to push smart meter installations.

o Threatening loss of access to cheaper tariffs without smart meters.

o Imposing higher default tariffs for customers who refuse smart meters.

• In 2023-2024, suppliers were exposed for remotely switching customers to pre-payment meters without consent, particularly targeting vulnerable groups.

• Following public backlash, new Ofgem rules were introduced to restrict forced pre-payment switches, especially for vulnerable households (e.g., over-75s, families with young children).

4. Tariff Structures & Incentives

• Energy companies increasingly offer preferential tariffs (e.g., Power Saver, EV Saver, Heat Pump Saver) only to customers with communicating smart meters.

• Half-Price Weekends or discounted tariffs require functioning smart meters capable of half-hourly data reporting.

• Some tariffs include “donation schemes,” such as Cancer Research UK support, integrated into the energy plan — raising concerns of emotional manipulation or coerced charitable giving.

5. Technical Problems & Consumer Frustration

• Numerous customers report:

o Delayed or missed scheduled inspections.

o Smart meters failing to send readings.

o Difficulty accessing discounted tariffs due to faulty meters.

o Confusion and lack of transparency in energy billing linked to smart meter problems.

• The widespread technical failure of smart meters has undermined public trust in the rollout.

• Suppliers have been criticised for not proactively notifying customers of faulty meters or resolving technical faults promptly.

6. Regulatory Oversight & Reforms

• Ofgem has increased oversight, requiring:

o Faster installations (within 6 weeks of request).

o Compensation for unresolved faults.

o Restrictions on remote switching to pre-payment meters.

• Consumer watchdogs (Citizens Advice, MoneySavingExpert, ARAG Law) highlight the legal right to refuse smart meters and recommend consumers document all interactions with suppliers.

• Despite regulation, consumer reports suggest suppliers still exploit loopholes and exert indirect pressure to encourage smart meter uptake.

The latest dispatch from the land of energy micromanagement comes courtesy of the BBC, who are dutifully informing us that the day/night tariff switch-off, due at the end of June, might render some people's meters inoperable. Naturally, the language is non-committal — might, possibly, could — all the rhetorical padding of uncertainty without the inconvenience of providing hard technical evidence.

You will recognise the hallmarks of a classic soft propaganda exercise. Whisper uncertainty into the public ear, nudge them towards pre-approved solutions, and let the machinery of gentle coercion do the rest. In this case, the unspoken "solution" is clear: get that smart meter installed — and preferably one that's communicating nicely with your energy overlords.

The older Radio Teleswitch Service (RTS), which facilitated day/night tariffs like Economy 7 by sending radio signals to compatible meters, is being phased out. The infrastructure is outdated, and energy firms have struggled to maintain it. From a purely technical standpoint, some meters may indeed fall silent without those signals. But there's no public technical documentation I can find proving that meters will cease functioning altogether. More likely, the tariff switching feature stops, not the basic metering itself.

But in the absence of hard data, we are left to interpret motives. Is this really a public information campaign? Or a clever psychological operation designed to manufacture consent for mass smart meter uptake? Given the recent history of supplier pressure, tariff blackmail, and the creeping normalisation of surveillance under the guise of "green efficiency," .........

At the very least, the BBC — allegedly a public service broadcaster — should publish technical transparency from suppliers and regulators alike. But instead, they parrot the talking points, leaving consumers caught between engineered uncertainty and the slow, relentless squeeze of energy-sector "modernisation."

In the end, the message is familiar: don't ask too many questions, just accept the smart meter — it's for your own good. Probably. Or not.

And of course, the end of June came and went, the signal was switched of and, as with the much-heralded millennium bug, bugger all happened. It was all propaganda.